[ANSWERED] Is Islamic Finance Better Than A Conventional Mortgage?

Is Islamic Finance Better Than A Conventional Mortgage?

Muslim home owners often wonder whether Islamic Home Financing is truly better than a conventional mortgage. Below, we provide three reasons why we feel that Islamic Home Financing is better than a conventional mortgage for Muslim home owners.

1. Islamic Home Financing Is Riba-Free

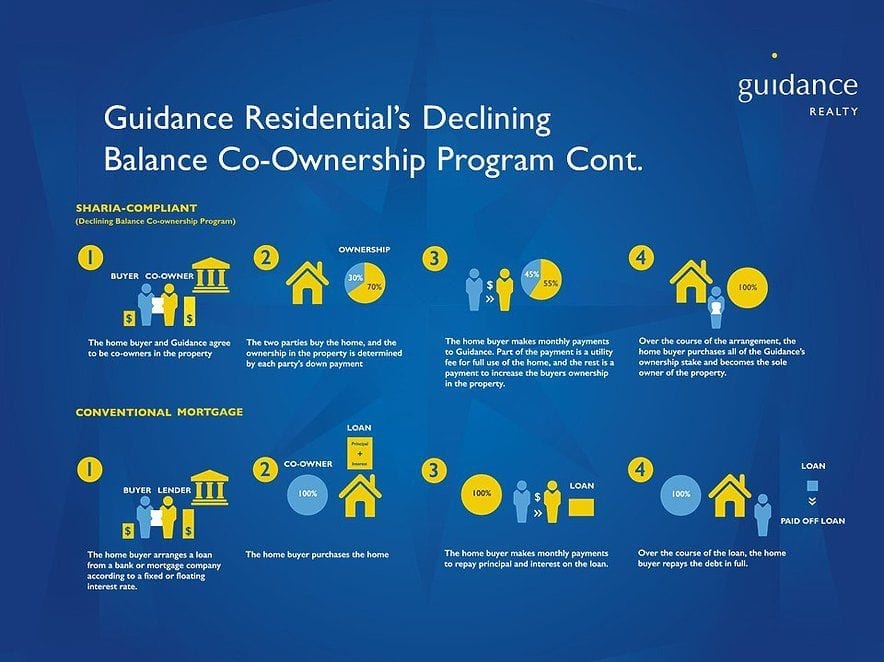

Islamic Finance is built upon a fundamentally different foundation than that of conventional lending. Conventional lending is based on Riba or Interest which is prohibited in the Islamic faith and also has a tendency to become exploitative (e.g. sub-prime mortgage scandal and subsequent financial crisis). An Islamic finance company cannot lend money for profit as making money on the exchange of money is prohibited. As such, the model that many of the world’s most prominent Islamic Finance scholars recommend for Sharia-compliant home buying is a Diminishing Musharaka (partnership) model where a service provider and the home owner function as partners engaging in a business venture with the home being the investment. The home owner functions like an investor buying stock in the company over time until they attain complete ownership of the tangible asset, in this case, a home. The best part about this is that it is not only Sharia-compliant home buying as it is riba-free, but just as affordable as a conventional mortgage.

2. Islamic Home Financing Is Just as Affordable

Given that the motive behind a conventional lender is to make money on the exchange of money, compounded interest becomes a powerful tool to drive up profits at the expense of the home owner. Islamic Financing, on the other hand, is ethically limited by the Sharia in how it can derive profits so making money off of compounded interest is not an option.

3. Islamic Home Financing is Less Likely to Foreclose

Given that a conventional lender is driven to make money on the exchange of money, they often aren’t financially incentivized to help home owners from foreclosing when they default on their payments. These sort of tendencies resulted in the recent sub-prime mortgage scandal that triggered the global financial crisis in 2008. Coincidentally, just as conventional financing was under immense scrutiny for the problems it was causing, curiosity about Islamic Finance peaked. Many public figures began to ask: could the global economic crisis have been averted if Islamic Financing been more readily available?

Sharia home buying through an Islamic home Finance company like Guidance Residential provides Muslim home owners benefits that conventional lending often lacks. Ethical financing that is competitive and less likely to foreclose provides home owners soundness of heart and mind allowing them to focus more on the things that matter like family, work, and community.