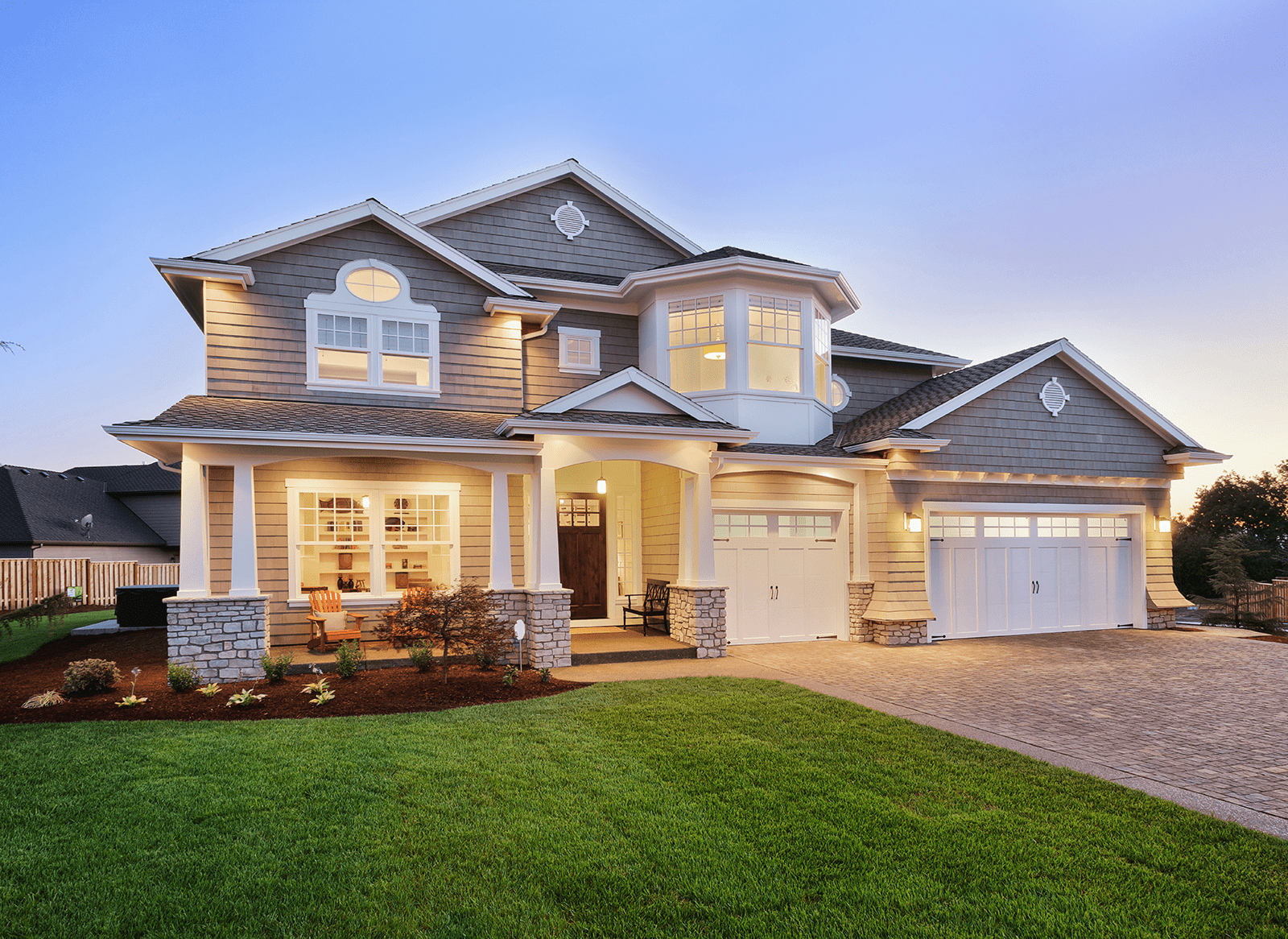

The Top Ten Mistakes Potential Home-Buyers Make When Purchasing a Home

For most people, purchasing a home is the largest financial transaction that they’ll ever make. The purchase decision is without a doubt, one that must be made with careful thought and attention to detail. A potential homebuyer has many things to consider when purchasing a home. A Muslim homebuyer has the added concern of finding Sharia -Compliant financing. With the help of our Guidance Residential Account Executives, who have decades of experience working in the home-finance and residential real estate industries, we’ve compiled a list of the top ten mistakes homebuyers tend to make.

Learn more about how Guidance Residential

10. NOT USING A REAL ESTATE PROFESSIONAL

Choosing the right professional for one of the most expensive purchases of your lifetime is essential. With the ease of access to tools like Google and Zillow unfortunately many people think they know it all. Don’t fall into this trap! You need to have an expert who has your best interest in mind, since the listing agent is representing the seller(s).

Your real estate agent should be is equipped with all the modern tools and technology, should have the knowledge of the local communities, ability to write proper contracts, negotiate on your behalf and most importantly hold your hand and walk you through every single step of your transaction. A good real estate professional will protect his/her client from potential issues that could arise from appraisals, inspections, and financing contingencies. Your real estate agent’s credentials are of utmost importance! It is a good idea to interview a few real estate agents before moving forward with one. Interview questions,such as the following can help you make the best decision for you and your family: 1) How many homes have you sold in the last year 2) How many clients are you currently working with and 3) Where have most of your clients purchased a home.

9. NOT HAVING A PLAN FOR WHERE YOU WANT TO PURCHASE A HOME

When looking for a home, the customer may not be fully aware of the characteristics of different areas. Start making a list of ‘Make or Break Deals’ for you in a home and those characteristics that are ‘Icing on the Cake,’ this will help narrow down your search list. Some common factors to consider include:School districts, ease of access, type of home, number of bedrooms and bathrooms, and Masjids.

When purchasing a home, also consider the expenses associated with the type of home you are purchasing. These expenses may be Homeowner Association Fees (HOA), Condo Fees,and insurance. Also, consider how long you plan on staying in the home because this will make an impact on your return on investment amount. You should ask yourself: “Are home prices in this area rising or declining?” “Do I plan to stay here for 5 or 10 years?” If you plan on residing in your home for a significant amount of time, consider improvements that are being made near your neighborhood, i.e. new developments or a new metro being built. These will (usually) positively impact your home value when you sell your home.

If you aren’t familiar with where you want to buy, we recommend asking your local real estate agent to show you 5-7 properties in different neighborhoods so you can familiarize yourself with the kind of house your money can buy in different areas, you can then start narrowing down your search.

8. NOT KNOWING THE HOME’S PROPERTY TAXES

Don’t forget about your real estate taxes! Property taxes can be a big game changer for a potential homebuyer’s ability to qualify for financing. Even if you plan on paying your taxes separately from your mortgage, your monthly taxes will still be taken into consideration when you are applying for financing. Make sure to ask about the home’s property taxes early on in the process!

7. NOT ORDERING A HOME INSPECTION

Some homebuyers tend to think that a home inspection is the same thing as an appraisal, and decide to skip out on ordering a home inspection. They are 2 different reports with 2 different purposes. The purpose of the appraisal is to give a market valuation of the home, while the purpose of a home inspection is to find out if there are any, hidden or apparent, defects in the home. Make sure to hire a licensed and reputable inspector who will explain things while going through the inspection!

6. NOT RENEGOTIATING AFTER A LOW APPRAISAL

It is vital that your purchase contract has an appraisal contingency clause that will allow you to back out of the contract and receive a refund of your earnest money deposit if the appraisal comes in lower than the sales price. It can actually be the cause of renegotiating the sales price and saving you some money! If the difference between the sales price and the appraised value of the home is significant you have strong grounds to argue that the seller of the home is overvaluing the home. If the seller is eager to sell the home then you as a home purchaser would be in a strong position to renegotiate the sales price.

On the flip side, if you and your family love the home and are willing to pay above market value for it, than the appraisal contingency does not have to kill the deal! Keep in mind, in a very competitive market or if you have a large down payment, it isn’t uncommon for buyers to waive the appraisal in order to make their offer more competitive.

5. NOT MAKING A SIGNIFICANT DOWN PAYMENT. NOT CONSIDERING THE PROFIT RATE IN SHARIA-COMPLIANT HOME FINANCING

Unless unable to, a potential homebuyer should always try to make a significant down payment. The mark that every homebuyer should aim to reach is 20%. A 20% down payment will give the homebuyer the best rate and give them significant equity right from the start of their mortgage.

On the flip side, you also want to consider the profit rate in Sharia-Compliant Home Financing. Sometimes first time homebuyers will want to save up 20% down, but at the expense of a higher profit rate. This ultimately will work against your original purpose of saving money. Consider all your options and speak to your local Guidance Residential specialist to determine the best option for you.

4. HAVING BAD CREDIT

One of the main criteria needed in order to receive any type of financing is to have good credit. Anybody who is thinking about buying a home will have to be mindful of their credit standing as it will play a major role in their qualification. It is important to remember that building credit does not have to be through paying interest. A potential homebuyer can build their credit through applying for secure credit cards, 0% car loans, and making sure bills are always paid on time!

3. NOT SHOWING ENOUGH INCOME ON TAX RETURNS (FOR BUSINESS OWNERS OR SELF-EMPLOYED INDIVIDUALS)

It can be very tempting for business owners or self-employed individuals to claim every expense under the sun in order to lower their taxable income. Unfortunately, that means that there’s less money entering their pockets in the form of profits at the end of the year. When applying for financing, your gross income is irrelevant. What banks will consider is your profits, or your net income.

2. NOT KNOWING THE DIFFERENCE BETWEEN SHARIAH-COMPLIANT AND CONVENTIONAL FINANCING

Finance in general is a field that can seem intimidating and confusing. Unfortunately, financial literacy is not as prevalent in the United States as it should be. The Muslim community, being a part of the broader society is affected by this issue. It is important that you work with a financial institution that you trust, and are aware of all the ramifications of the type of financing that you choose. There are many important differences between Sharia-Compliant or Islamic Financing and conventional financing. The first and most important difference is the fact that Islamic Financing is not based on a system of borrowing and lending. Islamic Financing is nearly always asset-backed financing. Sharia-Compliant Financing can provide protections not available in conventional financing. Learn more here.

1. NOT KNOWING THE DIFFERENCES BETWEEN THE TYPES OF ISLAMIC FINANCING

Not all Islamic financing options are created equal. When seeking home financing a homebuyer should consider whether the mode of financing they are choosing is non-recourse or allows the financier to take recourse against the homebuyer’s personal assets. A potential homebuyer also needs to consider whether this form of financing will allow them to refinance or restructure their contract. Another important consideration to make is whether the Islamic financial institution will take any risks along with the homebuyer.

Learn more about how Guidance Residential can help you with your home purchase or refinance.