What is the purpose of a Shariah Board in a halal mortgage company?

One of the important divisions of an Islamic home financing or a halal mortgage company is an advisory and supervisory body called the Shariah board. This body consists of a panel of scholars in Shariah, modern finance and more importantly, the Fiqh-al-muamalat, which is the set of rules that govern Shariah-compliant transactions. In this article we will be discussing about the structure, responsibilities and the importance of a Shariah Board in an Islamic home financing company.

What is the structure of a Shariah board?

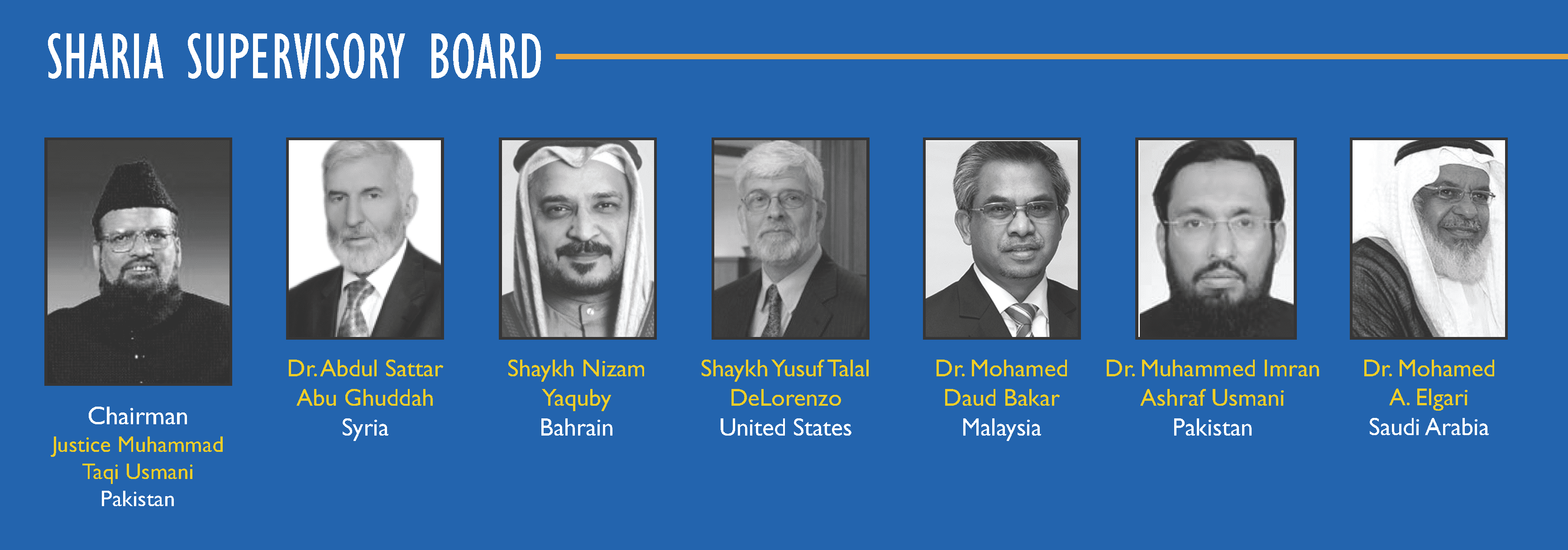

Although some companies take the advice of one scholar, most companies have a panel of three to six scholars in order to strengthen the advisory capacity of the board. In fact, it is an advantage to have more than one board member, as it ensures a diversity of scholarly opinions, backgrounds and experience. This collective decision making is very vital as Shariah-compliant financing is a sensitive subject to deal with.

Also, where a lone scholar’s opinions don’t cohere with a majority of his counterparts in the industry, it might result in the company being criticized for not being Shariah-compliant.

In practice, a Shariah board structure looks like this:

– An experienced scholar heads the board as the chairman

– Other scholars serve as board members, offering their advice when required and one among them acts as the board’s liaison with the company’s senior management

In the case of an international Islamic financial institution, there may regional Shariah boards, which report to a central Shariah board, located at the company’s headquarters.

What are its responsibilities?

A Shariah board will have both supervisory and advisory responsibilities. As the opinions of the board members would reflect on the image of the company and the product offerings concerned, it is highly essential that scholars of vast experience and practice are appointed to the board.

At a broader level, a Shariah board holds these major responsibilities:

– Ensuring that the day-to-day operations, investments and involvement in other businesses by the company are Shariah-compliant

– Ensuring that their portfolio of products or services are Shariah-compliant

– Research and development of new Shariah-compliant products and services.

– Performing annual audits, documenting resolutions, issuing Shariah-compliance fatwas and preparing reports for inclusion in the company’s annual report to provide a sense of credibility about the organization.

Why is it mandatory?

Shaikh Yusuf Talal DeLorenzo, renowned Islamic scholar and member of the Shariah board for Guidance Residential, observes that unless a financial product or service can be certified by a competent Shariah supervisory board, that product’s authenticity could be vague. In such a case, it will be the onus of the consumer to study as to whether the product actually complies with Shariah law.

Therefore, it is quite obvious that Islamic home financing companies should incorporate Shariah Boards within their organizational structure so as to provide the consumer with a feeling that their financing programs have authentic Shariah-compliance. With the number of Muslim-American home buyers growing at a good rate, the role of a Shariah board in a halal mortgage company cannot be understated. Their assistance in developing new products and services in compliance with Shariah principles, would lead to these companies reaching out with a broader set of product offerings to a wider audience. And this would lead to a larger number of Muslim-Americans accomplishing the sought after milestone of home ownership.