Cost of Islamic Finance Is Comparable With Conventional Home Loans

Some people are under the impression that Islamic finance is more expensive than conventional home loans. In the past, this once held true; however, it has been relegated to a myth in recent years as Islamic financing has become relatively cheaper.

Halal mortgages are now competitively priced to traditional mortgages.

Islamic Finance vs. Conventional Loan: The Differences

An Islamic mortgage is different from a conventional loan in some fundamental ways.

What Is an Islamic Mortgage?

First, it is important to understand the terminology. An Islamic mortgage is not a conventional mortgage loan — instead, it is based on an entirely different foundation.

A home may be financed in several ways while ensuring shariah compliance. Here are the three most common forms of Islamic home financing in the West.

- MurabahaIn a Murabaha transaction, the financial institution purchases the property and sells it to the buyer at a pre-agreed marked-up price. How It Works: This sale price includes a profit margin for the lender, and the buyer repays the amount in installments. Drawback: A downside is that a murabaha contract creates an obligation for the buyer that resembles debt.

- Ijara: Ijara is akin to a lease-to-own agreement. How It Works: The financial institution buys the property and leases it to the client for a specific period. During the lease term, the client pays rent, and at the end of the lease, they have the option to purchase the property. Drawback: In this type of arrangement, the buyer does not attain full homeownership rights until they finish purchasing the property, likely after several decades.

- Musharaka: In a Musharaka arrangement, the home buyer and the financing company agree to invest in a property as partners and buy a home together. How It Works: The home buyer gradually buys out the financier’s stake in the property, while paying a fee to use the part of the property still owned by the financier. Drawback: There is no major drawback of this approach. Musharaka is a form of co-ownership that conveys full homeownership rights to the home buyer from the beginning. It is the most suitable and popular form of Islamic home finance in America.

Shariah Compliance

A Muslim mortgage contract is halal in part because it does not involve the payment of riba, or interest.

It also is an asset-backed transaction. Asset-backed transactions refer to financial agreements where the financing is directly linked to tangible assets, in compliance with shariah principles. The transaction has a physical asset at its core, promoting transparency and reducing the risk of speculation, thus aligning with Islamic finance’s emphasis on fairness and justice.

What Is a Conventional Loan?

A traditional mortgage involves essentially buying money for more money. A bank or other lender has nothing to do with the home itself, so there is no asset involved. Instead, the financier allows the homeowner to use a certain amount of money in return for a promise to pay interest (in other words, more money) later.

This model creates an uneven and unequal relationship, in which the lender holds all of the power and profits from the buyer’s needs.

Benefits of Islamic Financing

Islamic home financing offers several key benefits over a conventional loan.

No Riba

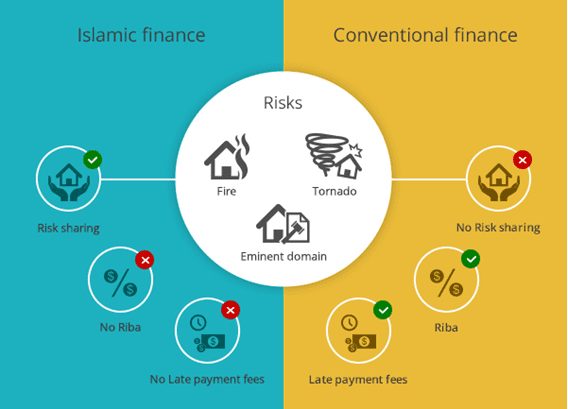

Islamic financing prohibits riba or interest. In Shariah-compliant home financing, the home buyer does not pay riba or interest to the finance company as he or she does when financing with a conventional home loan.

Less Financial Risk

Conventional loans place all of the risk on the home buyer.In contrast, Islamic financing shares the risk with the buyer.

One of the unique components of Islamic finance that makes it a more ethical form of financing than a conventional mortgage is the co-ownership or partnership program. Halal mortgage providers share the risks with the buyer since they act as a co-owner or partner.

In the case of a foreclosure, for example, if you can no longer pay and your home goes into foreclosure, Islamic mortgage providers do not receive more than the sale price of the house. With a traditional loan, you are responsible for the full cost of the home plus many more fees. A lender will expect to be paid in full regardless of the price the home ultimately sells for — even if that means pursuing the homeowner’s other assets. Guidance Residential does not do that.

Conventional home loan providers also do not share the risk of natural disasters or eminent domain. Similarly, in the case of a natural disaster or eminent domain (which is when the government seizes part or all of a property for public use), losses are yours to bear alone. Islamic home financing offers greater protection for the homeowner.

It is important to note that while Guidance Residential shares risks with the buyer, the company does not share the profit in the same way. If the home buyer sells the property, the homeowner keeps all of proceeds beyond the amount they are contracted to pay the company. It’s a win-win for the homeowner.

No Compounded Fees

Islamic mortgages do not compound late payment or prepayment fees.

Islamic finance providers aim to keep the entire home financing process Shariah-compliant, and therefore, will not compound late payment fees like conventional home loan providers sometimes do. Instead, Muslim financiers charge a fixed fee that covers the late payment fee expense and does not serve as a means for profit.

Additionally, conventional home loan providers sometimes charge a prepayment penalty to buyers who want to pay ahead of the agreed timelines. Guidance Residential does not charge a prepayment penalty — you are free to pay your home off early.

Islamic Home Financing is Competitively Priced

While halal mortgages offer multiple advantages over a traditional home loan, the costs are comparable. Islamic home financing once came at a higher price compared to a traditional mortgage, but this is no longer the case.

What Do Islamic Financing Rates Look Like in the United States?

As the Islamic home finance industry has grown in the United States, Islamic financiers have been able to lower the cost, so the cost is now comparable to the interest rates used for a traditional mortgage.

In fact, while the structure of the mortgage is completely different, the rates look similar. Islamic mortgage providers typically benchmark their rates with the current mortgage rates in the United States.

This helps consumers compare their options, and it helps government regulators ensure that the financier is following regulations in the services it is providing.

How Does This Differ From Riba?

Some people misunderstand the external resemblance between mortgage rates and Islamic mortgage rates. They ask: Doesn’t this mean that sharia compliant mortgages are just riba under a different name? However, this is not the case, as Muslim mortgages are a completely different product.

Under the surface resemblance, an Islamic mortgage contract is built upon a different foundation from a traditional mortgage loan, and that makes all the difference. Islamic financing is not riba, as no loan is involved.

Guidance Residential’s independent Shariah Board has examined this method of calculating a profit and found it to be completely Shariah-compliant.

The end result is that halal mortgages are now competitively priced compared to conventional mortgages. A halal mortgage has become an affordable option for those who wish to achieve homeownership without compromising their beliefs and principles.

What Does the Monthly Payment Consist Of?

At Guidance Residential, monthly payments consist of two portions that are combined into one.

The first portion goes toward buying Guidance’s share of the property.

The other portion compensates Guidance for the homeowner’s use of the financier’s portion of the property.

In this way, the homeowner retains full and exclusive rights to use the property while gradually increasing the share they own until have fully paid off the home and own it outright.

What Up-Front Expenses Should I Expect When Buying a Home?

No matter how you finance a home, the financial commitment will be similar. The largest up-front cost is the down payment.

In Islamic financing, the home buyer and the financier purchase the home together, each owning a portion of the home corresponding to the proportion each party contributes.

Ideally, the home buyer pays a down payment of 20% or more of the home’s purchase price. For a $300,000 home, this would mean a down payment of $60,000. Guidance Residential, however, may permit the home buyer to contribute as little as 5% of the purchase price, or $15,000 on that $300,000 home. For first-time home buyers, there are programs available that accept as little as 3% down.

In addition to the down payment, the buyer is responsible to pay closing costs at the home’s closing. This covers property taxes, home appraisal fees, homeowner’s insurance and mortgage insurance, and fees for other professionals who performed services for your transaction.

Closing costs typically equal 3% to 5% of the amount you are financing. For that $300,000 home, if you are financing $240,000 after your down payment, your closing costs could be $7,200 to $12,000.

Start Your Home-Buying Journey

A home purchase is one of the most important decisions you will make. The team at Guidance Residential is here for you, from the first step of pre-qualification or pre-approval, on through to finding the right real estate professional for you and your family — or refinancing a home you already own. We invite you to explore the home buying process with Guidance Residential today. You can also instantly calculate an estimate specific to your personal situation with our finance calculators online.

Guidance Residential remains the #1 U.S. Islamic home financing provider, with more than 40,000 families assisted over more than 20 years. Learn more about our co-ownership model of Islamic home financing, and get started on your home finance journey today.

Your Guidance Residential Account Executive is here to help with any questions. Looking to refinance or purchase? Have a friend or family member who is looking for a home? Call 1.866.Guidance, or start an application today.

Originally published in 2017, updated July 2025.