Top 3 Benefits of Refinancing Your Home

What Is Refinancing a Home and How Does It Work?

When homeowners think of refinancing, they often think it’s for one main reason — to lock in a lower interest rate. But there are actually a myriad of reasons why homeowners may choose to refinance their homes, from saving money to switching to preferred terms.

Before you make the decision to refinance, it’s important to understand how the process works, the benefits that you could see, as well as any downsides that you should be aware of.

Refinancing a home is a process where you’re essentially trading out your old mortgage for a new one. That new mortgage will have a new rate, but the balance might also be different.

There are two main types of refinancing: rate-and-term and cash-out refinance. Each offers slightly different benefits.

A rate-and-term refinance allows you to take advantage of lower rates. Your new mortgage would have a lower rate, and at the same time, you can change that mortgage to a shorter term if you would like to pay off your home sooner.

If you’re considering a rate-and-term refinance, it’s important to consider the costs of refinancing to make sure that the process is worth the expense. If you only have a few years left on your mortgage, then the savings you would see from a lower rate might not be enough to recoup the refinance costs that you would pay.

You might also explore a cash-out refinance. With a cash-out refinance, you’re essentially cashing out a portion of your home’s equity. The cash that you receive functions as a lower-interest loan, and you’ll get a chunk of cash that you can use toward large expenses like a major home repair, a new roof, or a kitchen renovation.

If you explore a cash-out refinance, keep in mind that you might see a longer mortgage term or larger payments to make up for the money that you’ve borrowed.

As a homeowner, the first step in refinancing is to fill out an application providing basic information to the home financing company so the financier can determine how much funding you may qualify for.

You can start with a quick pre-qualification application if you would like to obtain a rough estimate of the financing that may be available to you. But you can also choose to skip that optional step and move directly to a pre-approval application. During the pre-approval application process, you will be required to provide detailed financial documentation to verify your information.

Generally, refinancing an existing property is a more streamlined, faster, and less complicated process than financing a new property. First, the property is already chosen and there is no home search to contend with. Also, the title work needed usually takes 24-48 hours versus a much longer wait time for original title work when purchasing a new home. The appraisal process is also streamlined as scheduling an appraisal is quicker since the appraiser deals with the homeowner directly rather than a realtor. Overall, the timeline from the start of the refinance process to completion is much shorter.

When Should You Refinance Your Home?

Refinancing your home can be helpful in certain situations:

- You can reduce your rate or increase your term, so you’ll have lower monthly mortgage payments, as a result. These lower payments may be more manageable and allow you to live more comfortably.

- You’re eligible for a lower mortgage rate and/or shorter term. Taking advantage of these options can help to save you money on your mortgage, possibly letting you pay off your home sooner.

- You can eliminate your mortgage insurance. If you were required to take out mortgage insurance because you put less than 20% down on your home, you may be able to get rid of that insurance when you refinance. Keep in mind that you can also request to cancel this insurance once you’ve built up enough equity, so it’s not the sole reason to consider refinancing.

- You can switch from an adjustable rate to a fixed-rate loan. If you originally took out an adjustable-rate loan and want the stability and predictability of a fixed-rate loan, refinancing gives you that opportunity. You can also perform this process in reverse if you’re hoping to save money with an adjustable-rate loan.

- You can switch from a conventional mortgage to a Shariah-compliant, riba-free Islamic mortgage.

>> Related Read: What Is an Islamic Mortgage and How Does It Work?

How to Know if Refinancing Is Right for You

To determine if refinancing is right for you, it’s important to consider several factors, including the closing costs and how long you plan to stay in your home.

No matter which type of refinancing you’re considering, there are expenses, including closing costs involved. Even if a lender advertises refinancing without closing costs, those costs will be covered somehow.

It’s important to consider whether the benefits that you will see from refinancing your home will justify the costs of refinancing. It can take years before you recoup those costs, so think carefully about whether refinancing is really worth it in your situation.

You will also want to consider how long you plan to stay in your home. If you’re thinking of selling your home in the next few years, then refinancing to take advantage of a lower rate probably won’t pay off. If you’re refinancing to get cash to renovate your home, and could then make more when you sell it, then refinancing might be a good strategy.

There is no one rule about when it makes sense to refinance. Instead, you’ll need to consider your individual situation and goals to decide if it’s the right time to refinance.

>> Related Read – 4 Reasons to Refinance Your Home

What Are the Costs of Refinancing Your Home?

When you refinance your home, you will need to pay for several related expenses. The process might start with an application fee for refinancing. You will be responsible for paying that fee even if your application is rejected. These fees vary and depend on your home financing provider.

You will also need to pay for a home appraisal to confirm your home’s value. Plan to spend about $300 to $500 for the appraisal.

Depending on your state, you might also need to pay attorney fees. These fees vary by location. It’s also possible that your financier will require you to pay for a title search.

Finally, you will have closing costs, which can range from 2 to 3% of your remaining loan balance at the time of your refinance. You may be able to roll those costs into your mortgage, but in doing so you will pay more in the long run on these additional costs.

What Are the Benefits of Refinancing Your Home?

Refinancing your home offers many potential benefits. When you carefully consider your situation, refinancing can be a wise decision that could save you money. Many mortgage terms are for 30 years; refinancing gives you a chance to essentially reset your mortgage to your benefit.

If you think that you might want to refinance, then be sure to keep a close eye on the trends in the housing market. Fluctuating mortgage rates can affect what you’ll see or be eligible for when you refinance, and they may change regardless of whether refinancing is a good decision for you. The best thing that you can do is to be prepared with some money saved for your refinancing costs. Then, when rates drop below your current rate, you can take advantage and time your refinancing well.

Benefit #1 – Lower Monthly Payment

Mortgage refinancing may allow a homeowner to take advantage of cost savings options if the first mortgage term was not preferred or if the rates were too high due to market conditions. Refinancing may help a homeowner decrease their monthly payment by switching to a lower rate when market conditions are favorable.

Benefit #2 – Shortened Term

Refinancing can allow a homeowner to shorten their contract term.

Generally, rates are higher on a 15-year contract than a 30-year one, all else being equal; this means higher monthly payments, so many home buyers initially choose a 30-year contract when purchasing their home. But when rates drop, the homeowner may find that a shorter contract is now affordable.

Refinancing to a shorter contract can lead to big savings in the long run, because the homeowner will pay less in interest or—in the case of Islamic home financing—profit payments. In addition, the homeowner will enjoy all the benefits of a fully paid-off home years earlier.

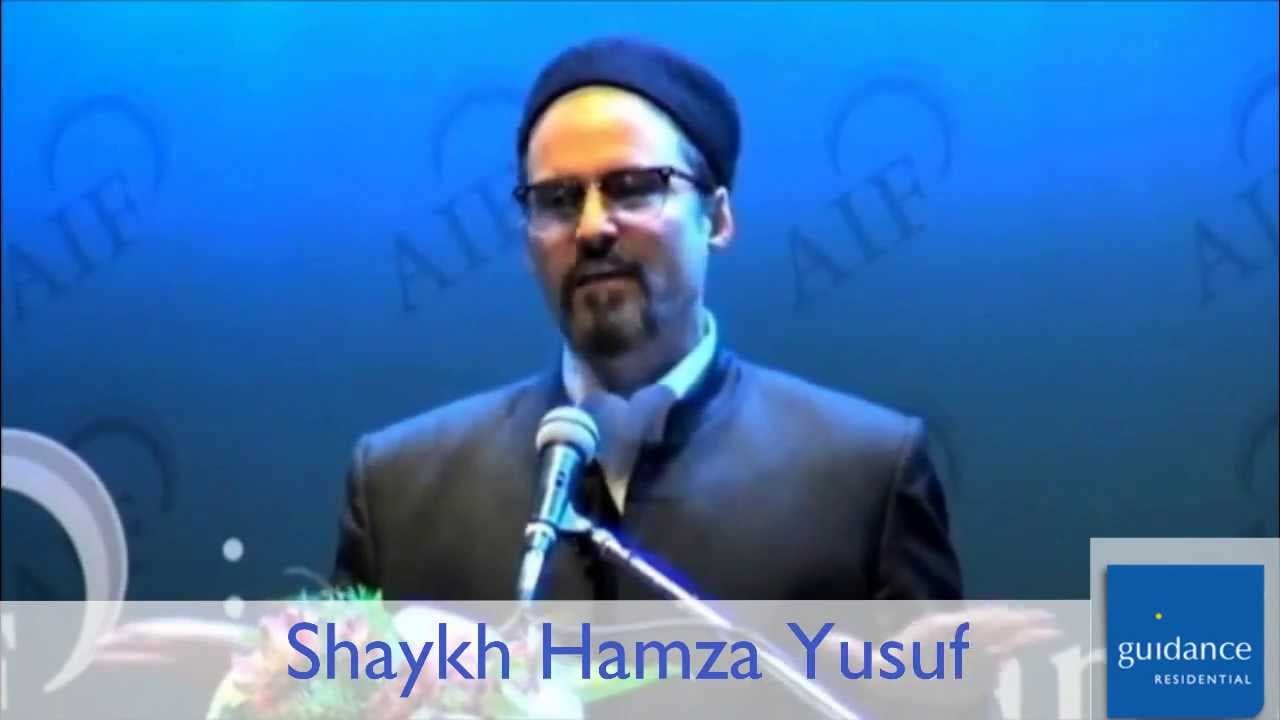

Benefit #3 – Alignment with Your Faith

According to Islamic legal jurisprudence, lending money to profit from any commercial or investment activity including the financing of real estate is not an acceptable method of commerce.

There was a time when faith-conscious Muslim American families did not have a sound alternative to a conventional home mortgage that was compliant with both the U.S. and Islamic legal systems. As a result, many Muslim families may have found themselves in a conventional loan contract that includes the prohibited practice of interest, or riba.

For homeowners concerned with upholding the principles of their Islamic faith, switching to a halal Islamic mortgage with a Shariah-compliant financier can be a smart move.

What Is a Halal Mortgage?

The primary difference between a halal mortgage alternative and a conventional mortgage is the foundation of the contract. For example, halal home financing with Guidance Residential is a partnership rather than a loan, so there is no debtor or creditor.

Our program is based on an Islamic financial concept known as “Musharakah Mutanaqisa” or “Diminishing Partnership.” In this model, the financier and the homeowner purchase the home together as partners.

>> Related Read: The Difference Between an Islamic and Conventional Mortgage

Mortgage Refinancing: How to Switch from Conventional to Halal

With Guidance Residential, it’s easy to switch to a halal alternative. We’ve been offering an authentic Shariah-compliant mortgage product since 2002. Our Declining Balance Co-Ownership Program ushered in a new era in home buying and refinancing for Muslim Americans, as well as non-Muslims who are drawn to the more equitable arrangement.

Since its inception, this competitively priced riba-free alternative to a conventional mortgage has helped more than 30,000 families realize their dreams.

Ready to explore your home refinancing options? Check out our competitive rates now.

Originally published September 2016, updated May 2024.

.